What is Gold Loan Per Gram and How Does It Work?

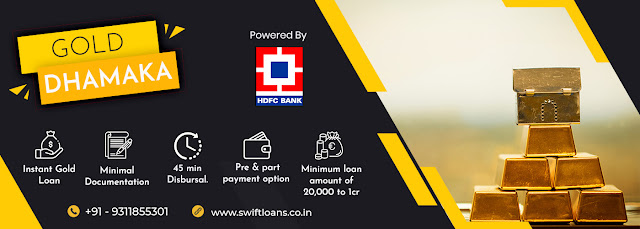

Gold Loan Per Gram is a type of loan that is provided against the collateral of gold jewelry or gold coins. The loan amount is determined by the current market value of the gold, which is usually calculated on a per gram basis. The lender, in this case, would hold the gold as collateral until the loan is repaid. Swift Loans provides gold loans to customers who require financial assistance. They use the latest market value of gold to determine the loan amount that can be granted, and the loan can be used for any purpose, such as paying bills, funding a business, or making investments. The repayment period is flexible and can be customized to suit the borrower's needs. Additionally, the interest rates on gold loans are typically lower than those of personal loans. In conclusion, if you're in need of financial assistance and have gold jewelry or coins, a gold loan from Swift Loans could be a convenient and affordable option to consider. The Advantages & Disadvantages of High...